Us hourly wage tax calculator 2019

Local income tax will not be charged regardless of the Texas state youre living or working in. Include your 2019 Income Forms with your 2019 Return.

Payroll Tax Prep Tax Preparation Payroll

Given that the second tax bracket is 12 once we have taken the.

. The tax calculator provides a full step by step breakdown and analysis of each tax. Click for the 2019 State Income Tax Forms. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Your Texas Paycheck Tax. TurboTax Can Help You With All Your Previous Years Tax Questions.

First enter an amount you wish to convert then select what. Our online Hourly tax calculator will automatically work out all your deductions based on your Hourly pay. Next divide this number from the.

How do I calculate hourly rate. US Salary Tax Calculator Calculate Check how your salary compares to the cost of living in New York Take-Home Pay in the US Simply enter your annual or monthly income into the tax. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Enter your income and location to estimate your tax burden. Annual Salary Hourly Wage Hours per workweek 52 weeks Quarterly.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Get Your Quote Today with SurePayroll. It applies to anyone living or working in the state.

2019 Hourly Wage Conversion Calculator This free tool makes it quick and easy to convert wages from one time period to another. Ad Complete Past Years Taxes And Get Your Maximum Refund Guaranteed. This comes to 102750.

All Services Backed by Tax Guarantee. Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10.

Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. Find out the benefit.

Select your age range from the options displayed. Enter the hourly rate in the Hourly Wage box and the number of hours worked each week into the Weekly Hours box. It can also be used to help fill steps 3.

Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income. Dont Wait File Today. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Get Started Today with 1 Month Free. Enter up to six different hourly rates to estimate after-tax wages for. Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator.

The 201819 tax calculator provides a full payroll salary and tax calculations for the 201819 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations.

In Hand Salary Calculator Best Sale 54 Off Www Quadrantkindercentra Nl

Payroll Tax Prep Tax Preparation Payroll

Full Time Annual Salary In The Uk 2021 By Percentile Statista

Hourly Paycheck Calculator Calculate Hourly Pay Adp

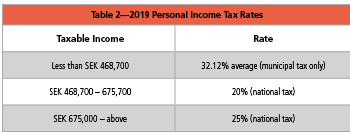

What You Need To Know About Payroll In Sweden

Sole Proprietor Vs S Corporation In 2019 S Corporation Sole Proprietor Payroll Taxes

What You Need To Know About Payroll In Sweden

Free Debt Snowball Worksheet Crush Your Debt Faster

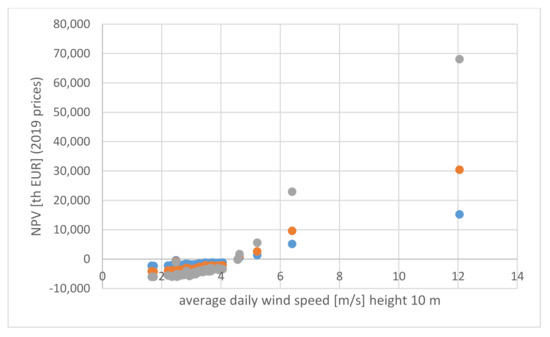

Energies Free Full Text Analysis Of Financial Problems Of Wind Farms In Poland Html

Free Printable Weekly Hourly Daily Planner Student Handouts Weekly Planner Template Daily Planner Template Weekly Planner Free Printable

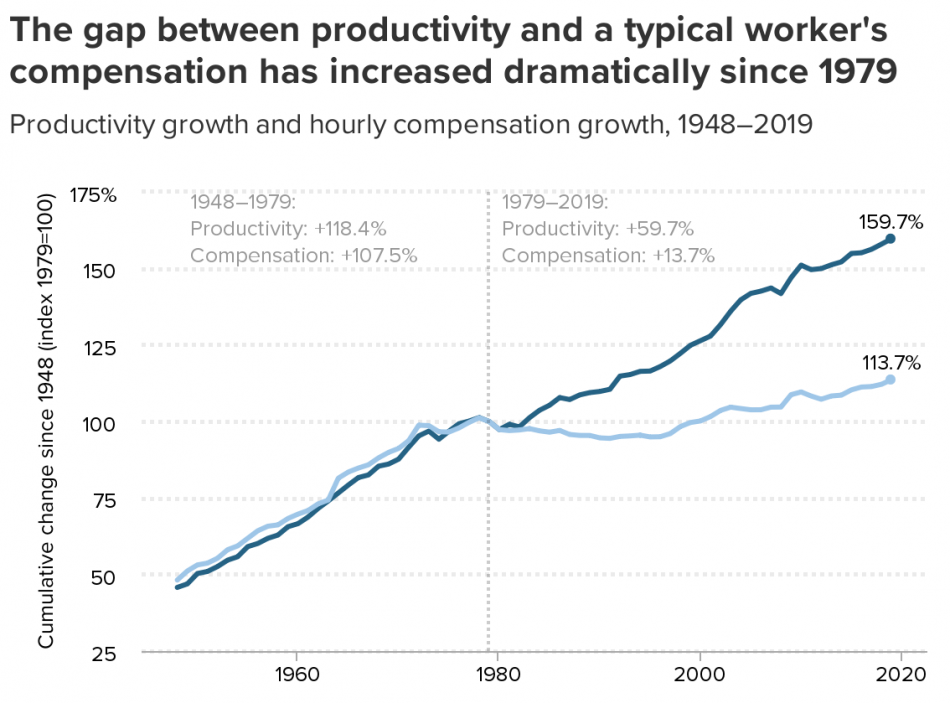

Growing Inequalities Reflecting Growing Employer Power Have Generated A Productivity Pay Gap Since 1979 Productivity Has Grown 3 5 Times As Much As Pay For The Typical Worker Economic Policy Institute

Calculate Child Support Payments Child Support Calculator Parental Income Influences Child Support Child Support Quotes Child Support Child Support Payments

Timeline Maker And Generator Lucidchart

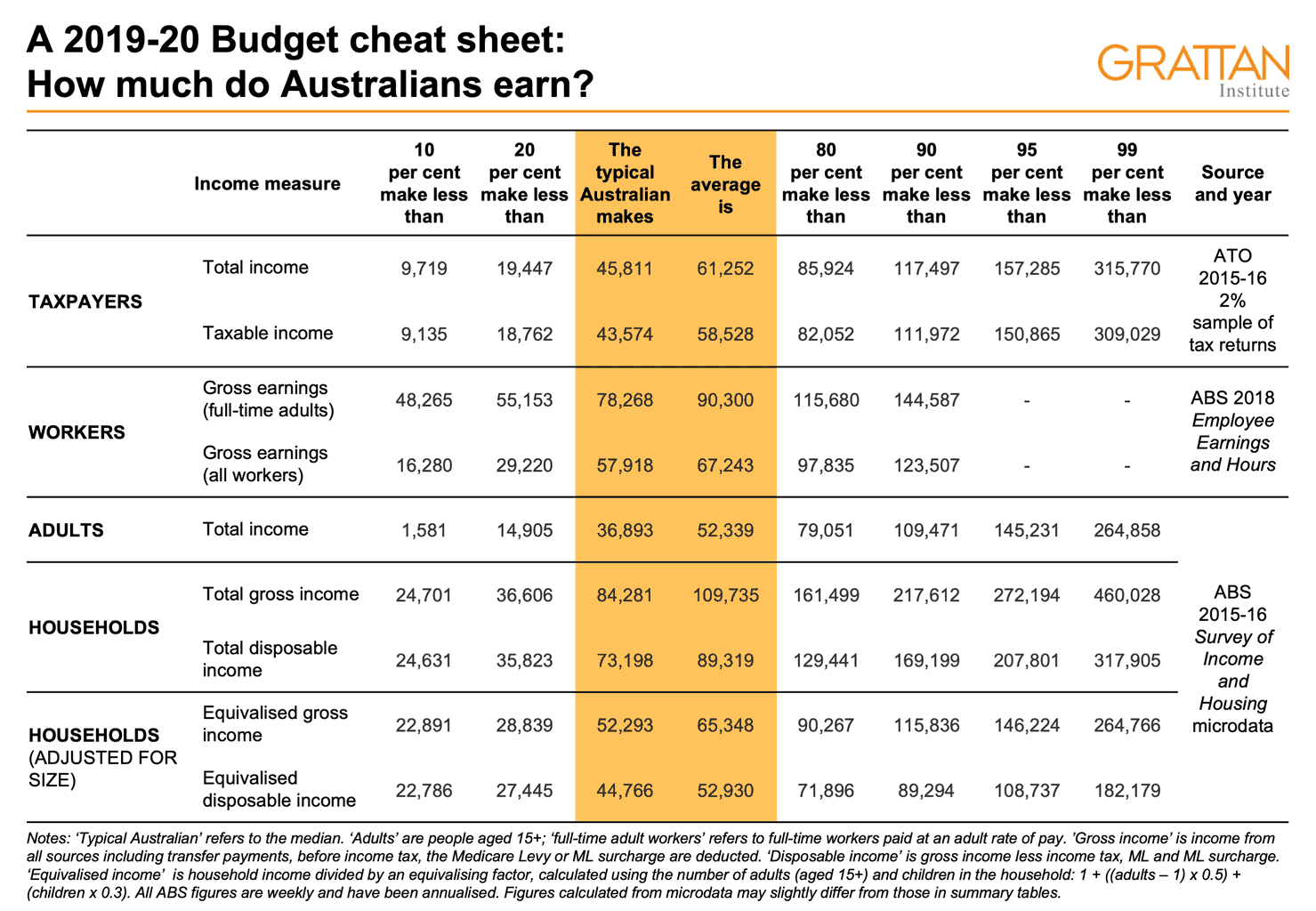

How Much Does The Typical Australian Earn The Answer Might Surprise You Grattan Institute

Wbso Tax Scheme For R D Projects Debreed Nl

Salary Breakup Calculator Excel 2019 Salary Structure Calculator Breakup Excel Salary

In Hand Salary Calculator Best Sale 54 Off Www Quadrantkindercentra Nl